无论是IG还是A-level,对于选择“经济学”这门课的学生来说,经济都是一门难啃的学科:知识点很多,涉及到很多理性推导和计算,大量essay写作任务。

可以说经济学是一门“文理横跨”的学科,既要有理科能力,也需要有文科水平。

对大部分中国学生来说,经济中出现的推导计算部分基本没什么太大难度。难度最大的就是essay写作,尤其是里面的evaluation部分。

今天这篇推文,以AS经济为例,我要教大家如果写出一篇高分 essay。

根据最新的CAIE AS经济考试大纲(2023版),考生们需要写2篇essay:2道微观题中选择1道作答+2道宏观题中选择1道作答。每一道题都由a,b两个部分组成,a部分8分(没有evaluation要求)+b部分12分(有evaluation要求)

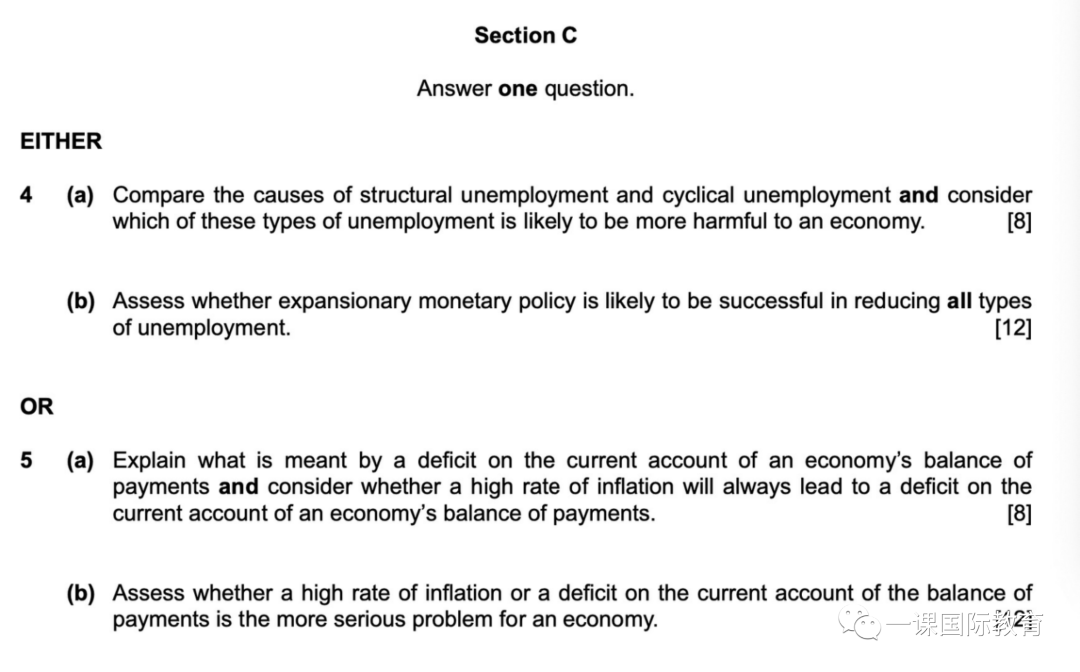

2023年essay样卷

Part b因为有evaluation的要求,所以很多学生会觉得非常难写。

想要把12分的b问写好,必须掌握它的文章结构,它大致分为4大部分。写作时必须把4部分都写完成才能拿到高分。

part1: knowledge,同学们必须把题目中出现的经济学术语都定义(解释)一下

Part 2: analysis+application 这个部分是顺着题目的意思进行逻辑推导,一般需要2条推导链(analysis),在推导的过程中需要增加一些现实生活中的例子(application)

Part 3: evaluation。这个部分主要反驳part 2中的观点。可以提出部分2中推导的局限性、政策可能会在现实生活中遇到的阻碍或者给经济带来意料之外的不好影响。

Part 4: conclusion。这个部分要把2/3部分中的key points归纳一下,记住一定要回答问题。

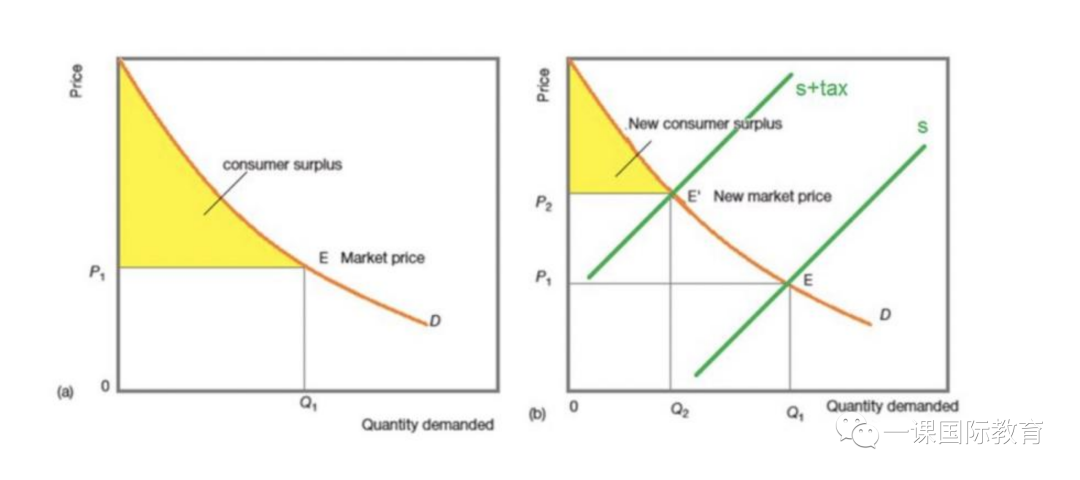

注意:在essay部分一定要多使用图形和例子,图形和例子可以加分

图形的注意事项:要标注准确横纵坐标,各个交点的名字,阴影部分代表什么

要对图进行文字描述,不是把图一画,丢在那里就不管了。

下面我们来看一道微观经济真题:

‘Indirect taxes reduce consumer surplus and should therefore never be imposed in a mixed economy.’ Discuss this view. [12]

审题:

先找到题目中出现的经济学术语,画下划线,后面要对它们进行定义。

‘Indirect taxes reduce consumer surplus and should therefore never be imposed in a mixed economy.’ Discuss this view. [12]

拆分任务

正式答题前要把题目仔细读一下,看清题目要求,拆分成几个小任务。

任务1: 证明间接税会降低消CS。

任务2: 顺着题目思路推导:indirect tax对经济有害,不该实施

任务3: 反着题目思路:indirect tax对经济有好处,应该实施

正式答题:

Part 1: Knowledge

Define indirect taxes, consumer surplus and mixed economy

In a mixed economy, some resources are owned by the public sector (government) and some are owned by the private sector. A form of government intervention in a mixed economy is to impost an indirect tax. An indirect tax is a tax that is levied on goods and services, VAT for example. Indirect taxation is said to reduce consumer surplus. Consumer surplus arises because some consumers are willing to pay more than the given price for all but the last unit they buy.

Part 2顺着题目的思路,正面推导 indirect tax→consumer surplus 下降→讨论不应该impose的情况

Explain how indirect taxes reduce consumer surplus and why this may be a disadvantage to the consumer.

It is true that indirect taxes may be a disadvantage to consumers because they reduce consumer surplus.This can be shown using a diagram.

Consumer surplus before the imposition of an indirect tax is represented shaded area under the demand curve and above the price line in figure (a). This represents the difference between the total value consumers place on all the units consumed and the payments they need to make in order to actually purchase that commodity.When the government imposes an indirect tax, the supply curve shifts upwards from S to S+tax. Price rises from P1 to P2 and quantity falls from Q1 to Q2. As price increases, the consumer surplus is reduced as some consumers are unwilling to pay the higher price. This reduction is shown in figure (b) The loss of consumer surplus is shown by the area P1P2E1E.

坏处1: Indirect taxes can have a negative effect if imposed on basic commodities such as food and clothes. Consumers will experience a fall in purchasing power.Since the indirect tax raises the prices of taxed commodities, it can prevent people from consuming those commodities. This is even worse for the poor or low-income workers.

坏处2: Not only indirect taxes reduce consumer surplus, but they are also regressive in nature.When a tax is regressive, the poor pay a higher proportion of their income as tax or they pay the same amount of tax as the rich. For example, if the tax on a commodity is 10%, whether somebody is rich or poor, they will pay the same 10%. An indirect tax will therefore affect the very poor more than the rich.

Part 3:逆着第二步做反向推导 讨论应该impose indirect tax的情况(也就是indirect tax的好处)=evaluation

Discuss why indirect taxes may be necessary.

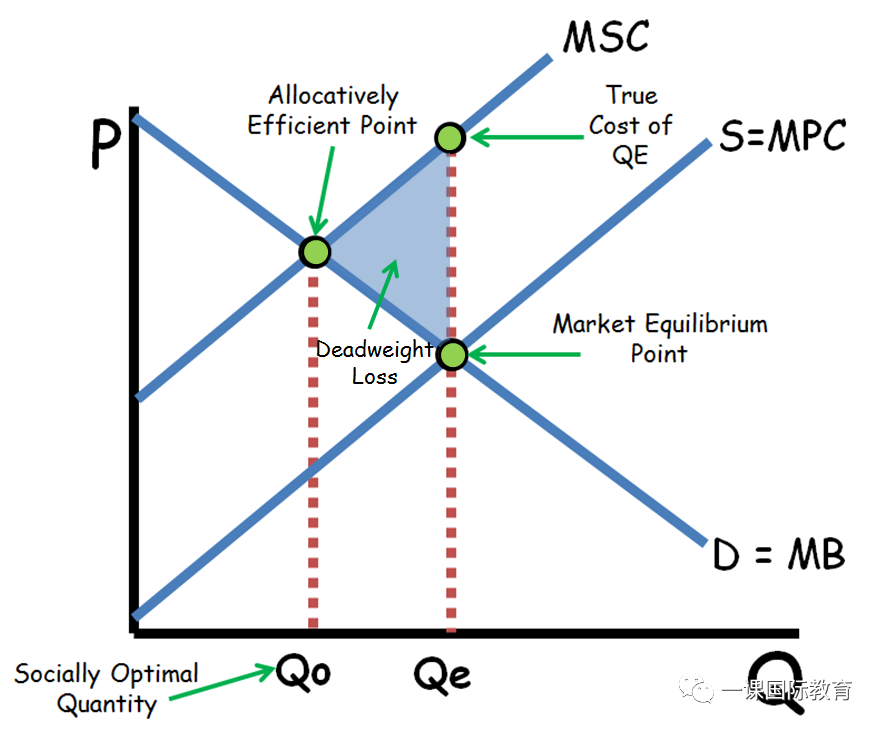

好处1: Even though an indirect tax reduces consumer surplus, this does not mean that they should not be imposed in a mixed economy. Indirect taxes can be used to correct market failures in a mixed economy. In order to discourage the consumption of a harmful good such as cigarettes, the government can raise taxes on cigarettes in order to increase the price. When the price is massively increased, consumers can afford to buy it like before and this, therefore, reduces the consumption of cigarettes.

好处2: It is also a significant revenue for the government. Indirect tax constitutes a very huge source of revenue for the government since the tax net covers a much wider area.Indirect taxes are considered a huge source of revenue for governments. This revenue can be used for government spending in critical sectors such as education and healthcare. This will help to improve living standards.

好处3: Tariffs, which is an example of an indirect tax on imported goods, can be used to prevent the dumping of certain undesirable commodities in the country.Dumping occurs when foreign firms sell their products in large quantities at prices deliberately below those charged by domestic firms, often even below the cost of production. High tariffs raises the prices of imported goods and discourages people from consuming them. The end result is that local industries are protected and the dumping of certain commodities in the country is mitigated. Indirect taxation can be a very powerful tool in protecting infant or home industries against foreign competition.

Part 4:总结,把前2段的论点简单归纳一下,放在一起

Conclude.

To conclude, it is true that taxes reduce consumer surplus and may considerably impact lower-income families, however, this does not mean that indirect taxes should never be imposed. Indirect taxes should be imposed in some cases even if it reduces consumer surplus. It can be used to correct market failures such as pollution and the consumption of demerit goods. Taxes are a valuable source of revenue to the government in a mixed economy and is used to finance merit goods such as education and healthcare. Consequently, indirect taxes should be imposed reasonably.

我的习惯是让学生在审题之后/正式下笔之前,先做一个大纲,罗列出关键点。

通过下面这个更贴近生活的例子,相信你对essay的结构,evaluation的写法会理解的更透彻。

题目:评估一下“双减政策”是否能成功提高生育率。12分

1.双减政策的介绍(knowledge)

2.双减政策可以提高生育率(正面推导/analysis+举例application)

减少补习班---减少焦虑-----提高生育率

减少补习班----降低家庭支出--提高生育率

3.双减政策不能提高生育率(反面/evaluation)

a. 就算没有正规的机构,家长也会寻找black market给孩子补习。ped小

b. 影响生育率的因素不止机构,还有父母工作性质(加班),房价高,观念改变等问题

c。Unintended consequence: 双减政策会导致一批教育工作者失业,失业率上升,GDP下降,引起焦虑,可以还会降低生育率

4.总结:从理论上可以提高生育率,因为减少焦虑;

但是生育率还受很多方面影响.....

(总结就是把前面的观点再整理一遍,区别是前面的表达非常详细,总结很概括)