Keywords: AE, inflationary gap, policy effectiveness

评分:

AO 1&2(knowledge, understanding and analysis):14 points

AO 3(Evaluation):6 points

Question: Explain what is meant by an inflationary gap,and discuss the effectiveness of the policies a government might use to reduce an inflationary gap. (20)

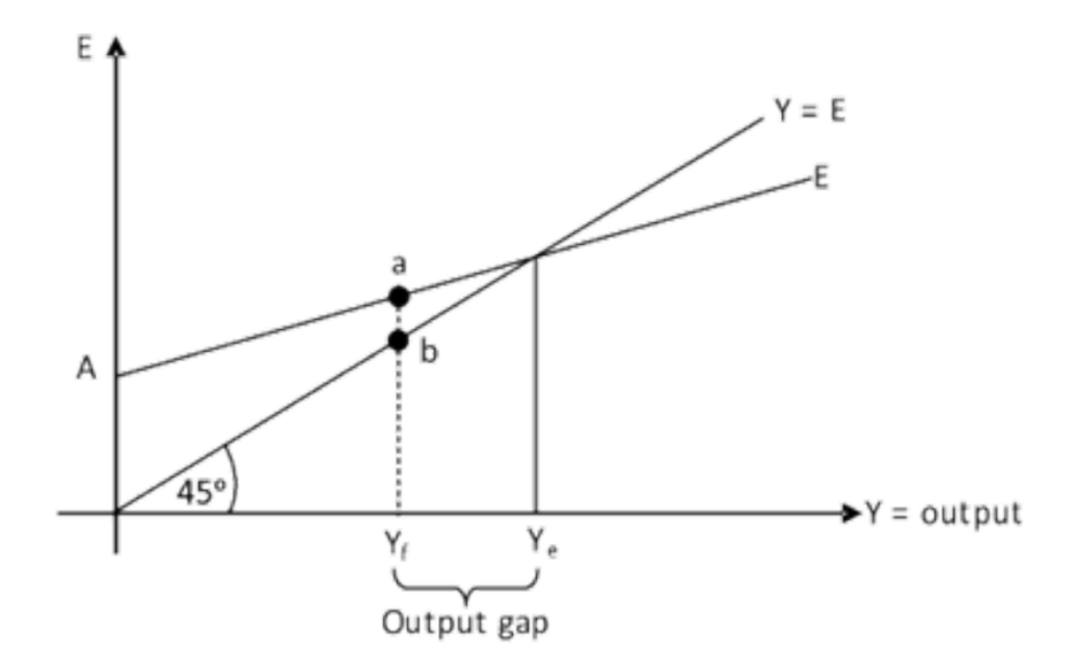

(画图说明什么是inflationary gap并对解释图像)

Inflationary gap is the vertical between 45-degree line and expenditures function at the level of full employment. Inflationary gap arises when the equilibrium income is above the full employment level. It measures the amount by which aggregate expenditures exceed income and triggers demand pull inflation/inflationary trends.

Equilibrium income is determined by the intersection of 45-degree line and expenditures function, which is Ye in the diagram. Full employment is at Yf and the vertical distance between the 45-degree line and expenditures function at this level indicates the inflationary gap. The gap between full employment level(Yf) and equilibrium income is known as output gap.

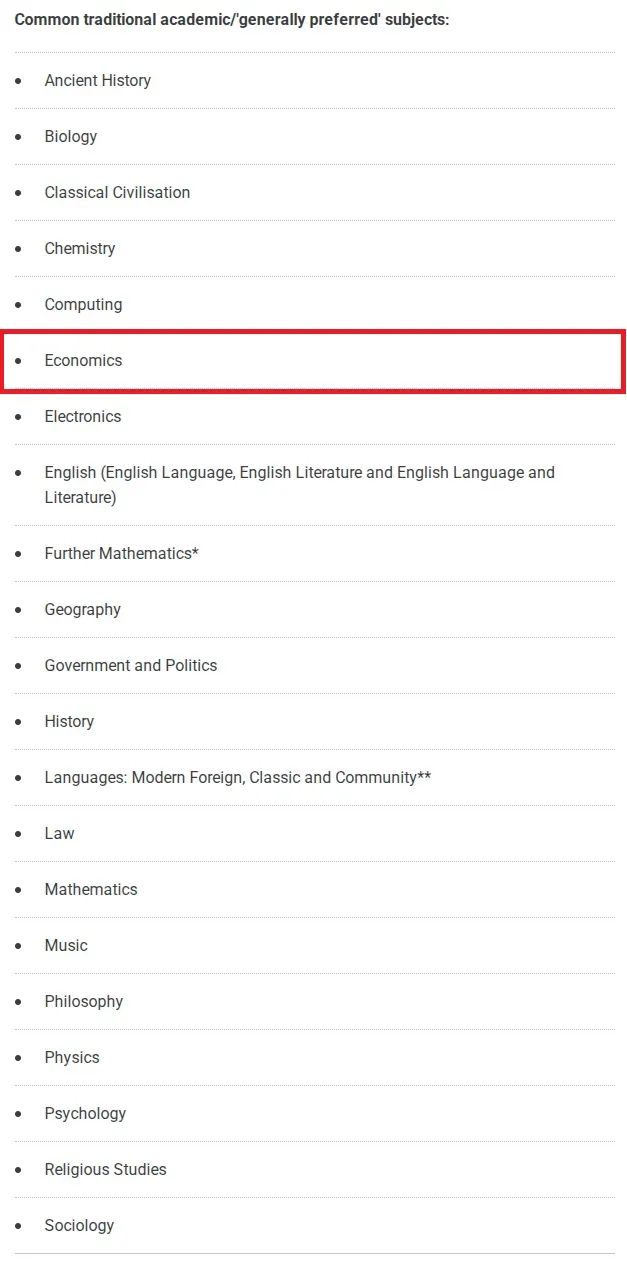

(分析使用财政政策和货币政策、包括调节汇率在内,是如何消除inflationary gap的)

The government may decrease government spending and/or raise Net Taxes (T) to reduce an inflationary gap. The government spending should be decreased exactly by the size of inflationary gap to completely fill the inflationary gap. However, taxes should be raised by a higher amount than the size of the gap, as higher taxes reduce disposable income and affect both consumption, which is a part of aggregate demand (or aggregate expenditure), and saving. So, increased taxes have a smaller effect on aggregate demand(AE) than lowering government spending.

(不要求掌握,但可以提tax multiplier小于government spending multiplier及原理)

The government may decrease the supply of money or raise interest rate to decrease aggregate demand (AE) and reduce the inflationary gap. Interest rates are a reward for savings and higher interest rate increases savings and result in less consumption. Interest rate is a cost of investment and higher interest rates decrease investment. Decreased consumption and investment reduce the aggregate demand(AE) and help to reduce the inflationary gap.

Exchange rate should be raised/revalued to reduce the gap. Higher exchange rate makes exports expensive and imports cheaper, resulting in lower net export and hence lower aggregate demand (AE), which will reduce/fill the inflationary gap.

(加图,由以上政策使用所引发的AE下移及inflationary gap减少的效果)

(评估部分:政策可操作性、可能会遇到的阻力、效果所取决于的因素,财政政策效果受crowding out effect的影响等等)

Fiscal policy is more effective as it is easier to calculate the required change in government spending and/or taxes to fill the inflationary gap. The effect of an increase in interest rates on consumption and investment is uncertain as it depends on how responsive consumption and investment are to an increase in interest rate. Fiscal policy, however, may not be effective, as lower government spending decreases the borrowing requirement of the government, resulting in lower interest rate, which may increase consumption and investment, reducing the effect of decreased government spending. Fiscal policy means approval of parliament and may take longer than a change in interest rates, which can be made relatively quickly. A contractionary fiscal policy is more effective when backed by a contractionary monetary policy. The exporters may resist a government move to raise exchange rates and only governments with a trade surplus and high foreign reserves can use the option of increasing the exchange rate