阅前须知:本文只提供可能的回答方式,文中没有提到的内容不一定没有分,提到的内容也不一定出现在ms里,所有内容都仅供参考。

1(c)Labour shortage, wage上涨, cost of production上升, price level上涨. Workers demand for higher wage, wage再上涨, wage-price spiral.

1(d)先定义PED, 解释PED小于1 (不知道有没有分).

necessity涨价, PED小于1, total expenditure上升, 对low-income earner不利,因为这些necessity的支出占总支出的比例很大;nominal income不变, real income下降, purchasing power下降.

其他consequences: fiscal drag,redistribution of income.

1 (e)ir上升减少AD, ir上升er上升降低cost of imported price of raw materials, 两个都减少inflation.

AD下降也无法降低price level (不在full-capacity), er上升幅度太小无法cover油价上升, ir上升er不一定上升(其他国家ir也上升)

第二个policy (不知道有没有分), supply-side policy降低cost of production, 简单写下正反面.

2(a) AO1:income, income inequality, Gini coefficient

Income is the reward for the services of a factor of production. For labour, income is paid in wages, salaries and bonuses. For other factors of production, income takes the form of rent, interest and profits.The Gini coefficient is a numerical measure of the extent of income inequality in an economy. If the income distribution in an economy is equal, the Gini coefficient is equal to 0;if all income accrues to just one person, then the Gini coefficient is 1. A lower figure of Gini coefficient indicates a more equal distribution of income.

AO2:two causes of income inequality

- level of eduction

-employment status

AO3: which is more significant in low-income country

Evaluate comment: 大部分人受教育程度低,掌握的技能比较少,即使大家都有工作,他们的工资也会比少数受教育程度高的人低很多。

Conclusion: level of education是比较重要的原因。

2(b) 可以写的policy包括minimum wage, direct tax,transfer payments, direct provision.

每一个policy是什么,对应的effectiveness和ineffectiveness都需要写

AO1: policy instruments

AO2: first policy to reduce income inequality

A transfer payment is a payment from tax revenue that is received by certain members of the community. These payments are not made through the market, as no production takes place.

If unemployment benefits are provided, the unemployed would have additional funds available to engage in vocational training. This could improve their skills and assist them in earning a higher income in the future. Meanwhile, offering essential services, such as food coupons and housing allowances, to low-income individuals can help lift people out of poverty and protect them from further economic difficulties. This ensures a healthier workforce and gives them the opportunity to earn more money through work.

However, unemployment benefits and benefits for those on the lowest incomes can act as a disincentive to work. People who are unemployed may find it more difficult to secure another job the longer they remain out of work. This is because they miss out on training, become out of touch with advances in technology, and may lose confidence. If they rely on unemployment benefits to make a living, their income will not increase in the future, so that income inequality may widen.

The extent to which transfer payments can be paid is dependent on how much tax is collected and how many people have paid tax. In low-income countries, this is affected by all sorts of problems. For example, Pakistan has a growing elderly population, yet it has a low tax base. Pension and social security coverage is limited to the formal sector and therefore only covers a small percentage of the population. Those who work or who have worked in the informal sector are not covered by these schemes.

AO2: secondpolicy to reduce income inequality

AO3: compare two policies,write an overall conclusion

如果第一个policy写的是针对low income的, 那第二个policy可以写针对high income的(比如direct tax),这样一个比较好的ev point就是如果gov可以有效收到税,那可以有更多的revenue提供给transfer payment,两个policy一起使用效果会更好。

* 如果大家有时间,可以简单写一下用capital gain tax解决wealth inequality. 但这个应该不在ms里。

3(a) AO1: merit goods, demerit goods, examples

A merit good is a good that is thought to be desirable but which isunderprovided by the market. For example, an inoculation against acontagious disease is a merit good. Other people benefit from theinoculation, as they will not now catch the disease from the inoculatedperson.

A demerit goodis seen as any product that isthought to be undesirable and which is overprovided by the market.Eating too much ‘junk food’ is a demerit good becauseoverconsumption of fatty foods with few nutrients may cause ill health.

这里我用的教科书的定义和例子,大家也可以按照正确的写法来写。

由于CIE分不清externality和information failure,这里无论写哪种都可以。

需要注意的是这里的example必须给出这个商品为什么是merit/demerit。

AO2, AO3根据印度卷ms回答:

AO2:subsidy, market impact of subsidy

AO3:why subsidy is ineffective

这里可以写的点包括ped<1, misuse of subsidy

AO2, AO3根据23年ms回答:

AO2:subsidy, market impact of subsidy, why subsidy is ineffective

AO3:whether subsidy is always ineffective

AO3可以写的点包括虽然PED小于1,但Q总能增加一些。因此只要不是misuse of subsidy,Q虽然不能达到optimum,但也可以增加。

3(b) 答题格式和2(b)一样。

内容和印度卷差不多, 只是把indirect tax换成了minimum price, AO2和AO3大家看这篇即可:

AS经济2024印度卷essay解析(微观)

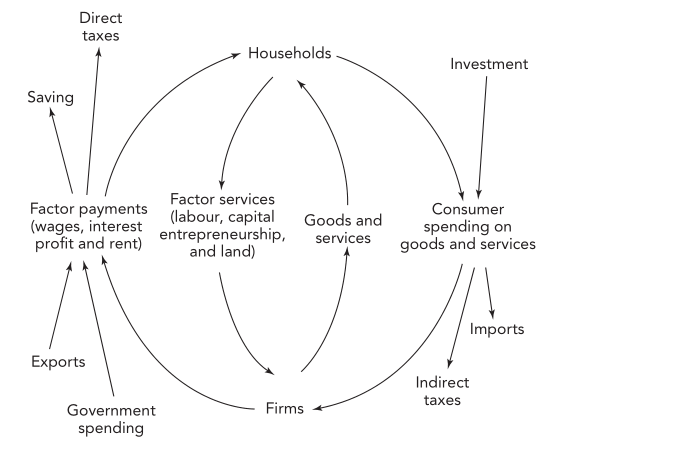

4(a) AO1:circular flow of income, diagram

The circular-flow diagram represents the transactions in an economy by flows around a circle.

In the model of the circular flow of income, households provide factor servicesto firms and receive factor paymentsin return. Households also consume goods and services, allowing firms to receive money from households once again.

In an open economy, injection is the money flowing into the economy, which includes government spending, investment and exports. A leakage is spending by households which does not flow back to domestic firms and therefore leads to a reduction in real GDP. Leakage is the money flowing out of the economy, which includes taxation, savings and imports.

AO2: 用circular flow 解释 economic growth

Real GDP is the total value of all final goods and services produced in the economy during a given year, calculated using the prices of a selected base year. Economic growth is an increase in an economy’s output, which is measured by changes in real GDP.If there is an increase in export, injections exceed leakages at the current level of national income. Firms will respond to the higher level of export by increasing production to meet the additional demand. As production increases, firms may hire more workers, leading to higher incomes for households. With higher incomes, households are likely to increase their consumption of goods and services, which in turn increases real GDP.

AO3: why circular flow could not explain economic growth

这里有两个可以写的点:

1. 如果economy在full employment, injection不会增加real GDP, 这无法在图上体现

2.Circular flow的图无法体现productive capacity的增加

4(b)AO1:long-term growth

答题的结构依然和之前两题的b问一样。

Supply-side policy需要给2个instruments, 比如education, infrastructure或者R&D

由于这里问的是long-term growth, 第二个policy写demand-side可能不是很好(虽然ms可能认可), 这里最好写protectionist policy来发展infant industry.

5 (a)AO1: protectionism,two policy tools

Protectionism is when governments seek to protect domestic industries from foreign competition. Protectionism involves the restriction of free trade.Import tariff are taxes imposed on imports. There are two key reasons why governments impose import tariffs: one is to discourage consumption of imports; another is to raise tax revenue. Export subsidies may be given to both exporters and to those domestic firms that compete with imports. In both cases domestic firms will experience a fall in costs. This will encourage them to increase their output and lower their price.

AO2, AO3根据印度卷ms回答:

AO2:how tariff reducesimports(可画图解释)

AO3:why tariff is ineffective

这里可以写的点包括ped<1, 加了tariff价格依然低于domestic firms

AO2, AO3根据23年ms回答:

AO2:howtariff reducesimports,whytariffis ineffective

AO3: whether tariff is always ineffective

AO3可以写的点包括depends on是否有retaliation, depends on tariff rate

* 这题大家应该都会写import tariff, 不过写export tariff也可以得分;我不认为import tariff和export tariff都要写。

5 (b)AO1: free trade

AO2: benefits of free trade

AO2: arguments for protectionism

AO2一边写3个点, 必须link到developing country

这里可以link的点包括生产primary goods有comparative advantage,有很多infant industry.

AO3:free trade or protectionism?

可以写的点包括但不限于:

- domestic market是否competitive (如果是,那protectionism可以更容易让infant industry发展;如果不是,那容易形成依赖)

- 是否有足够的income来diversify economy (如果有,那需要尽可能的进行diversification, 因为依赖农产品在长期对经济不好; 如果没有, 那需要先通过free trade提高income)

- economic condition (high inflation,那优先控制通胀,最好减少protectionism)

考虑到这张卷子难度略高于印度卷,盲猜分数线会比印度卷低2-3分。

印度卷的分数线会在5月下旬公布。