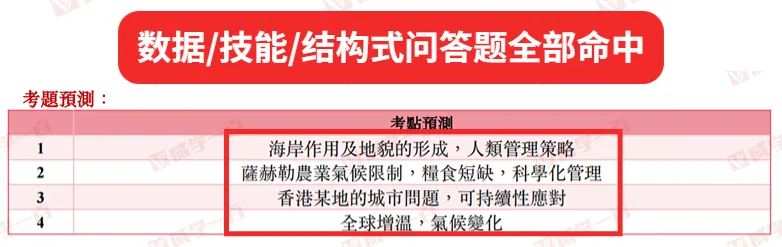

综合写作回忆

关于远洋船只的西北航线。

学术写作分析

Doctor Diaz

We are discussing recent trends in consumer behavior. One trend is a decrease in the use of cash money. Consumers don't use physical money to pay for things as much as they used to. Online shopping has a big impact on this. But even when shopping in person, more people are using credit cards, cash cards, and phone apps to make purchases. So do you think the decrease in using cash is positive or negative? Why?

Andrew

I think it's great. l avoid using physical money. The main reason is that l don't want to carry around a wallet stuffed with paper bills and coins. l carry my mobile phone with me anyway, so why carry two things when l only need one? Using my phone to pay for things in the storeis a huge convenience.

Claire

I think it's negative. it's easier to keep track of your spending when you use cash. When paying with cards or phone apps, it's easy to ignore how much you spend and go over your budget. But with physical money, you are more aware of your spending, and if you run out of cash, you can't spend any more!

审题分析

1. 这题重复了23年9月24日的考题。当天老师就第一时间出了考题分析,今天再次分享给大家。

2. 现金的减少,是很多原因造成的:比如国外习惯使用信用卡,我国喜欢手机网络wechat, Alipay ….

3.可行的思路:

--现金使用的减少的好处:

① 给人们带来了方便。因为现在人们可以使用信用卡(外国人使用多), 手机支付,甚至还可以通过面部识别来支付,所以人们就不用带钱包,只需要带卡或者手机。甚至这些都不需要带,可以刷脸。想要买东西,购物就直接出门去买。Besides, 也不用担心没有零钱无法支付的尴尬情况。比如,有时候乘坐公交,地铁,需要1.2块买票,但自己只有10多块。只能跟旁边的好心的陌生人换钱。但是如果可以刷卡,就没有这些麻烦事了。

② 给人们带来了安全。如果带现金钱包的话,很容易被偷。尤其是在国外旅游的时候,一般带的现金比较多,就非常容易成为成为小偷的目标,很不安全。但是如果用手机支付等,即便是被偷,小偷不知道密码也无法进行转账,所以被偷的几率大大减少。就非常安全。

现金使用少的坏处:

1. 给人们造成了不方便。有些地方只收现金。(国外这种情况很多)

2. 导致花钱多。因为没有不用cash, 钱就变成了数字,自己很容易就随便花出去了。

👩🏻🏫:这道题思路不难,主要还是其中很多生活化表达,需要同学们注意。

参考范文:

I wholeheartedly agree with Andrew's argument that the decreasing use of cash has positive implications for society.Primarily,the convenience factor cannot be overstated.Nowadays, more and more retail outlets, shopping malls, and organizations are transitioning tonon-cash payment methods, such as credit cards, online payments, and even facial recognition technology.As a result, people cango shopping, dine out, or attend eventswithout the burden of carrying cash. All they need is a single credit card or just their smartphone. In some instances, even these are unnecessary as facial recognition payment systems are becoming increasingly popular.

Furthermore, moving away from cash transactions eliminates the minor yet frustrating problem of needingexact change.We've all faced situations where we're rushing to catch public transportation, only to realize we don't have the correct change for a ticket. This inconvenience often leaves us relying on the kindness of strangers forloose change(零钱).With digital payments, however, such concerns are a thing of the past. A few taps on a smartphone screen, and the fare is paid effortlessly.

In conclusion, the decline in cash usage, attributed to the rise of more convenient alternatives, offer clear benefits for people in their everyday lives.