观点类大作文,社会类话题

Some people think we should keep all the money we earn and not pay tax to the state . To what extent do you agree or disagree?

题目来源:2023年6月10日大陆雅思大作文

1、题目大意

有些人认为我们应该保留所有赚来的钱,不向国家交税。你是否同意?

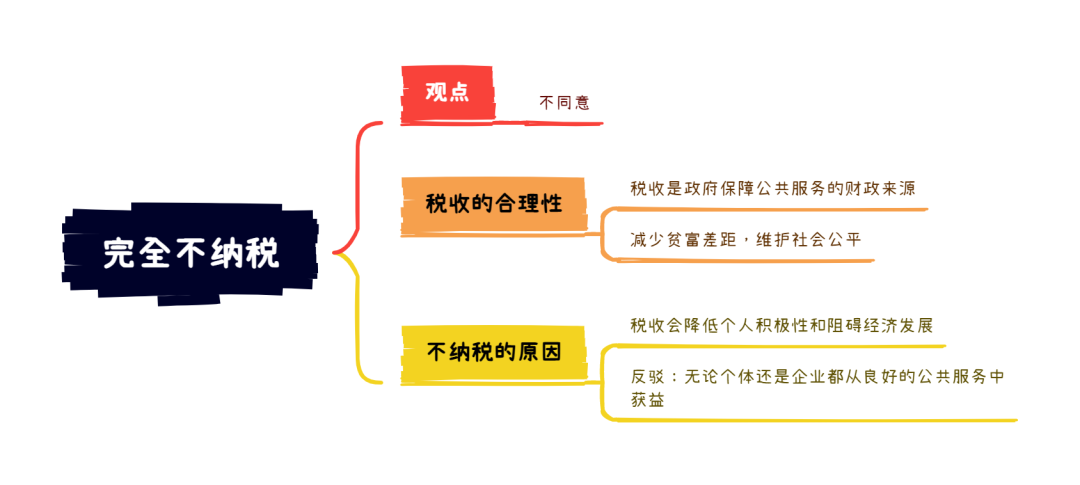

2、思路解析

这是一道观点类大作文,聊得是税收问题,和4月15日的写作的话题是同一类。审题时需要注意绝对化表达“all”,一般遇到绝对化观点持反对角度更容易切入。下面,月半鸭和大家一起来看下具体观点。

首先来看合理性,高额的税收确实可能会阻碍经济活力和民众赚取高收入的动力,能够全额保留自己的收入是个人自由和权益的体现。同时,创新或创业都需要资金的支持,如果税收过高,可能会影响个人可用资金的投入以及对于回报的期待,进而影响社会经济的发展。

再来看反对的角度,有两方面。

一是税收是政府运行和提供公共服务的主要来源。这些公共服务包括但不限于教育、医疗、社会保障、基础设施建设等,并且每一个居民在日常生活中都会从这些公共服务中获益。如果每个人都保留自己赚的所有钱,政府可能没有足够的资金来维持这些重要的公共服务。

二是税收可以帮助维护社会稳定和调节社会贫富差距,如果每个人都保留自己的全部收入,可能会导致贫富差距进一步扩大,从而引发社会的不稳定。通过对高收入者更高的税负,并用以帮助贫困者,可以在一定程度上实现财富的再分配,减少社会的贫富差距,促进社会的公平。

3、提纲

4、高分范文示例

Some individuals believe that retaining all the money they earn and avoiding taxation is a justifiable course of action. However, I strongly disagree with this notion, as I believe that paying taxes to the state is essential for the overall well-being of society.

Taxes serve as a crucial means for governments to fund essential public services like education and healthcare, ensuring equal opportunities and well-being for all citizens. Additionally, they contribute to the development and maintenance of indispensable public infrastructure such as roads and utilities, which are vital for a modern society's smooth functioning and economic growth. Furthermore, taxation plays a significant role in promoting social equality by reducing wealth disparities through progressive tax systems, which help redistribute wealth and support vulnerable populations via social programs.

It is true that some critics may argue that taxation can hinder economic growth and stifle individual motivation due to the perceived loss of personal income. However, this perspective overlooks the numerous benefits that individuals and businesses alike can derive from a well-funded public infrastructure and social programs supported by tax revenue. For instance, companies can benefit from efficient transportation systems and an educated workforce, while individuals can enjoy a higher quality of life through access to public services like healthcare and education.

In conclusion, taxes are essential for funding public services, developing and maintaining public infrastructure, and promoting social equality. Failing to contribute to these vital aspects of society through tax payments would result in a less prosperous, less equitable, and less functional society overall.

范文作者:Sophia

5、相关词汇和语法结构

vehemently disagree 强烈反对

critical instrument 关键工具

finance vital public services 资助重要的公共服务

ensuring equal opportunities 确保平等机会

seamless operation 无缝运作

fostering social equity 促进社会公平

diminishing wealth disparities 减少财富差距

progressive tax systems 渐进税制

redistribution of wealth 财富再分配

vulnerable populations 弱势群体

social initiatives 社会倡议

impede economic growth 阻碍经济增长

suppress individual motivation 抑制个人动力

myriad advantages 无数优势

well-funded public infrastructure 资金充足的公共基础设施

knowledgeable workforce 知识丰富的劳动力

enhanced quality of life 提高生活质量

sustenance of public services 维持公共服务

culminate in 达到高潮;以...告终