本次作文真题讨论话题:教育话题 大家可以先跳过语言关,先用中文简单表达自己的观点,哥在留言区等大家的评论哦~事不宜迟学习时间到👇

话题分类

教育话题

大作文题目

In many countries, students who leave high school have no understanding of how to manage their money. Why is the case? What can be done to improve students’ understanding of how to manage personal finance?

题目解读

本题写作任务是分析高中毕业的学生不知道如何管理自己钱财的原因,并给出相应的解决方案来提高学生对个人理财的理解。

参考范文

The lack of financial literacy among high school graduates in many countries can be attributed to a combination of factors. This essay will delve into the main causes and offer potential solutions to the problem.

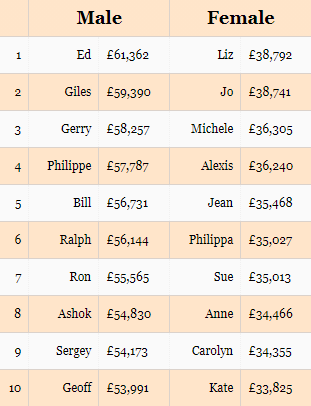

One primary reason is the absence of comprehensive financial education in standard curricula. Traditional education systems often focus on academic subjects, neglecting practical life skills such as personal finance management. As a result, students may leave high school without a fundamental understanding of budgeting, saving, investing, and navigating financial decisions. Another contributing factor is the reluctance of parents or guardians to discuss financial matters openly with their children. Money-related topics may be considered taboo or private, leaving students without guidance on crucial aspects of personal finance. Additionally, the rapidly changing economic landscape and the advent of digital financial tools have added complexity to financial decision-making, making it essential for students to acquire updated and relevant knowledge. To address this issue and improve students' understanding of personal finance, several strategies can be implemented. Firstly, integrating financial literacy education into the standard school curriculum is crucial. Schools should offer courses or modules that cover topics such as budgeting, banking, credit, taxes, and basic investment principles. This approach ensures that financial education becomes a fundamental component of a well-rounded education. Furthermore, educators should leverage interactive and practical teaching methods to engage students in real-world financial scenarios. Simulations, case studies, and hands-on activities can enhance students' ability to apply financial concepts in practical situations, preparing them for the challenges they may face in adulthood. In addition, online resources and mobile applications can be utilized to make financial education more accessible and appealing to the tech-savvy younger generation. In conclusion, addressing the lack of financial literacy among high school graduates requires a comprehensive approach that involves changes in curriculum and teaching methods. By equipping students with practical knowledge and skills in personal finance, we can empower them to make informed and responsible financial decisions as they transition into adulthood.

重点词汇/语料

financial literacy

金融知识

be attributed to a combination of factors

归因于多种因素

the absence of comprehensive financial education in standard curricula

标准课程中缺乏全面的金融教育

academic subjects

学术科目

personal finance management

个人财务管理

a fundamental understanding of budgeting, saving, investing, and navigating financial decisions

对预算、储蓄、投资和财务决策有基本的了解

reluctance

不情愿,勉强

the rapidly changing economic landscape

快速变化的经济格局

the advent of digital financial tools

数字金融工具的出现

have added complexity to financial decision-making

是否增加了财务决策的复杂性

acquire updated and relevant knowledge

获取最新的相关知识

integrate financial literacy education into the standard school curriculum

将金融知识教育纳入学校标准课程

courses or modules that cover topics such as budgeting, banking, credit, taxes, and basic investment principles

涵盖预算、银行、信贷、税收和基本投资原则等主题的课程或模块

a well-rounded education

全面的教育

leverage interactive and practical teaching methods to engage students in real-world financial scenarios

利用互动和实用的教学方法,让学生参与现实世界的金融场景

simulations, case studies, and hands-on activities

模拟、案例研究和实践活动

students' ability to apply financial concepts in practical situations

学生在实际情况中应用金融概念的能力

prepare them for the challenges they may face in adulthood

让他们为成年后可能面临的挑战做好准备

make financial education more accessible and appealing to the tech-savvy younger generation

让金融教育更容易获得,并吸引精通科技的年轻一代

equip somebody with something

使某人具备

empower students to make informed and responsible financial decisions as they transition into adulthood

让学生在步入成年后做出明智和负责任的财务决定